Common Mistakes to Avoid When Applying for Cash Loans

Wiki Article

Whatever You Need to Understand About Cash Advances: An Easy Break down

Cash advances can be a quick option for those looking for prompt funds. They permit individuals to gain access to cash money using their charge card limitations, particularly in emergencies. The convenience comes with considerable expenses, consisting of high costs and passion prices. Understanding the ins and outs of cash advances is vital prior to choosing. What choices exist, and just how can one use them sensibly? The solutions might stun you.What Is a Cash Advances?

A Cash advances is a financial service that permits people to take out cash against their charge card restriction. This service provides quick access to cash, frequently utilized in emergencies or when conventional financial options are unavailable. Cash advances can be acquired at Atm machines, banks, or through credit score card companies, offering adaptability in exactly how and where money is accessed. The amount readily available for withdrawal generally depends on the cardholder's credit limit and particular terms established by the charge card issuer.However, cash advances usually feature greater costs and passion rates than regular charge card purchases. They might also begin building up rate of interest immediately, without an elegance duration, making them an expensive alternative over time. People taking into consideration a cash loan must thoroughly assess their financial scenario and potential repayment approaches to prevent unnecessary financial debt. Understanding these variables is necessary to making notified monetary choices relating to cash advances.

Just How Do Cash Advances Work?

Cash advances operate by enabling people to access a section of their bank card limitation in money form. This procedure usually includes utilizing an atm machine or visiting a financial institution where the bank card is issued. The private inserts their debt card, goes into the desired quantity, and obtains money, which is subtracted from their offered credit line.Rates of interest for cash advances are typically greater than typical purchase rates, and interest starts gathering right away, without a moratorium. In addition, many charge card impose a cash development cost, which can be a percent of the amount taken out or a fixed buck amount.

Pros and Cons of Cash Advances

While cash advances can give quick access to funds, they come with both benefits and disadvantages that people ought to thoroughly consider. One significant benefit is the immediacy of cash money accessibility, allowing individuals to attend to urgent economic requirements without prolonged approval processes. Furthermore, cash advances are often obtainable even for those with less-than-perfect debt, giving a financial lifeline in emergencies.The disadvantages are significant. Cash advances usually lug high-interest prices and costs, which can lead to significant financial debt if not handled properly. Furthermore, they do not offer the same customer defenses as standard financings, leaving debtors prone to negative terms. The brief payment durations can likewise aggravate financial strain, particularly if people are already experiencing cash money circulation concerns. As a result, recognizing both the challenges and benefits is crucial for any individual thinking about a money development as an economic option.

Tips for Utilizing Cash Advances Responsibly

Understanding the accountable use cash advances can aid mitigate their prospective drawbacks. People ought to first assess their financial circumstance and establish if a cash advancement is truly essential. Setting a clear settlement plan is vital; debtors should intend to pay off the breakthrough asap to reduce passion expenses. Additionally, it is a good idea to limit cash advances to emergencies or inevitable costs, preventing unnecessary reliance on this option.Maintaining a budget plan that includes cash loan settlements can protect against future financial strain. People should additionally recognize the costs connected with cash advances, as these can vary considerably. Checking spending practices and guaranteeing that cash advances do not cause a cycle of debt is crucial. Looking for monetary suggestions when in doubt can supply valuable understandings, eventually guiding individuals toward even more lasting monetary practices.

Alternatives to Cash Advances

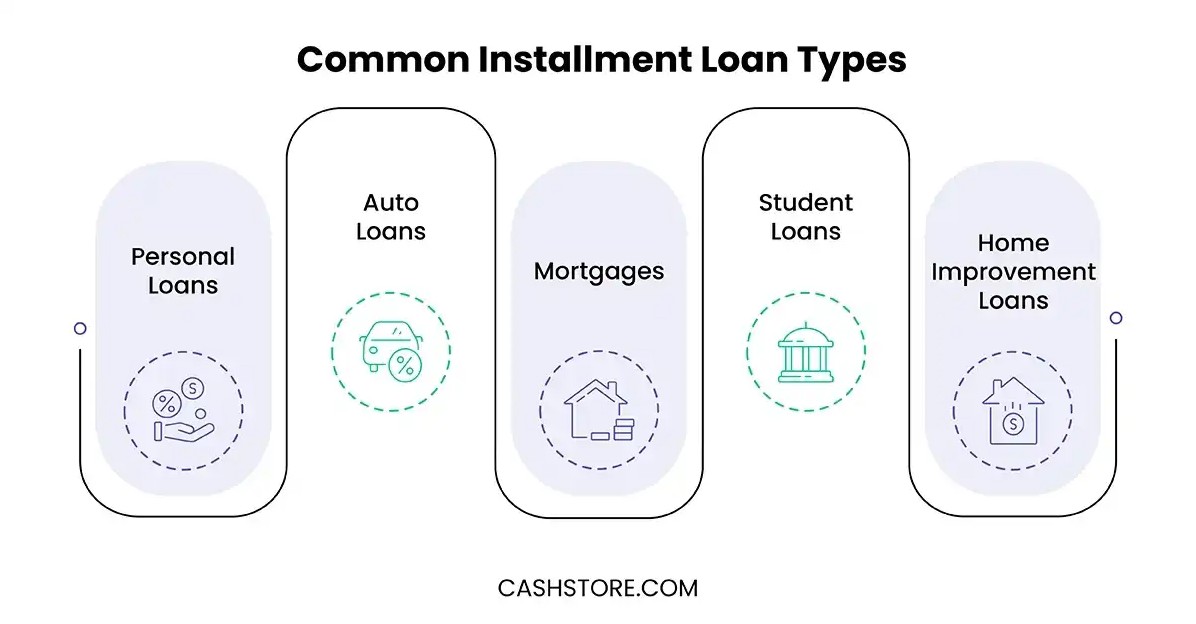

Numerous options to pay advancements can supply individuals with monetary relief without incurring high charges and passion prices. One alternative is individual loans, which usually offer reduced rates of interest and longer payment terms compared to cash loan. Debtors can likewise take into consideration credit union choices, as these organizations frequently supply positive terms and lower charges.An additional choice is borrowing from good friends or family members, which may feature versatile settlement plans and no interest. In addition, Payday Loans people may check out side jobs or independent work to create supplementary income quickly.

Moreover, making use of a budget plan or seeking financial counseling can help take care of expenditures and relieve the demand for immediate cash. Eventually, some might take advantage of negotiating settlement strategies with creditors, permitting them to spread out payments without high expenses. By discovering these choices, individuals can discover much more sustainable solutions to their financial needs.

Regularly Asked Questions

Are Cash Advances Available on All Credit Report Cards?

Cash advances are not globally readily available on all bank card. Each card company has certain terms, and some cards might not offer this attribute. It's essential for cardholders to examine their private charge card contracts for information.Can I Make Use Of a Cash Development for Overhead?

Yes, cash advances can be utilized for overhead. Nevertheless, people must think about greater rates of interest and charges related to cash advances, which may affect the total cost-effectiveness of financing business-related acquisitions in this fashion.Just how Long Does It Take to Get a Cash Money Advance?

Commonly, getting a cash loan can take anywhere from a couple of minutes to several business days. Elements affecting the timeline include the lender's handling speed, the applicant's financial establishment, and the method of disbursement picked.

What Occurs if I Can Not Repay a Cash Money Advance?

If a cash money advancement isn't paid back, the customer might deal with enhanced rates of interest, extra costs, and possible damage to their credit report. Lenders may additionally start collection actions, bring about more monetary issues for the customer.Exist Limits on Cash Money Development Amounts?

Yes, there are limits on cash breakthrough amounts. These limits differ by lender and are typically affected by the debtor's credit reliability, account type, and overall credit line, making sure liable loaning and minimizing risk for loan providers.A money advance is an economic service that permits people to withdraw cash against their credit score card limitation. Fast Cash. Cash money advancements can be obtained at Atm machines, financial institutions, or through credit rating card companies, providing adaptability in exactly how and where money is accessed. Cash money advancements frequently come with greater costs and passion prices than normal debt card purchases. Money developments operate by enabling individuals to access a portion of their credit card limit in money form. Cardholders must be mindful that not all credit rating card limits are offered for cash money developments, as particular limits might use

Report this wiki page